Onwards is a product-led VC Fund

We partner with founders to build exceptional products from day one.

Why We Exist & Our Promise to You

Early-stage investing is often backwards. VCs ask for financial projections and progress towards hitting metrics. But they are rarely the ones in the trenches with you to actually equip you to achieve them. Some offer "platform" support but this will never replace the value of a trusted valued thought partner and problem solver.

Our Promise to You

We're in the trenches with you - we are "venturers"; whether you're on top of the world, or (especially) when you're at the bottom of a trough, we aim to be your first call as a founder.

That's how we measure our success.

What Makes Us Different

We're operators, not just investors.

We dig where others skim

While most funds ask for your TAM slide, we want to understand your users' workflow. We care about retention curves, not hockey sticks.

How we do it:

Provide fast, honest feedback

Act as collaborative partners, not just check-writers

Walk the talk - we are ourselves a product-led fund

We've been in your seat

Whether you are a first-time founder or a seasoned operator, we have the expertise and the compassion to help you navigate.

How we do it:

Bringing deep product, growth and people expertise

Being a no-judgment sounding board

We look for underdogs

We aren't looking to work with those that have it all. We focus on gritty, under-resourced but over-ambitious founders and we level the playing field.

How we do it:

We vet for exceptional teams that don't have the regular access/privilege

Structuring clean, fair rounds with long-term alignment in mind

We leverage our network of founders and venture builders

How We Engage: Our Product

We walked the talk

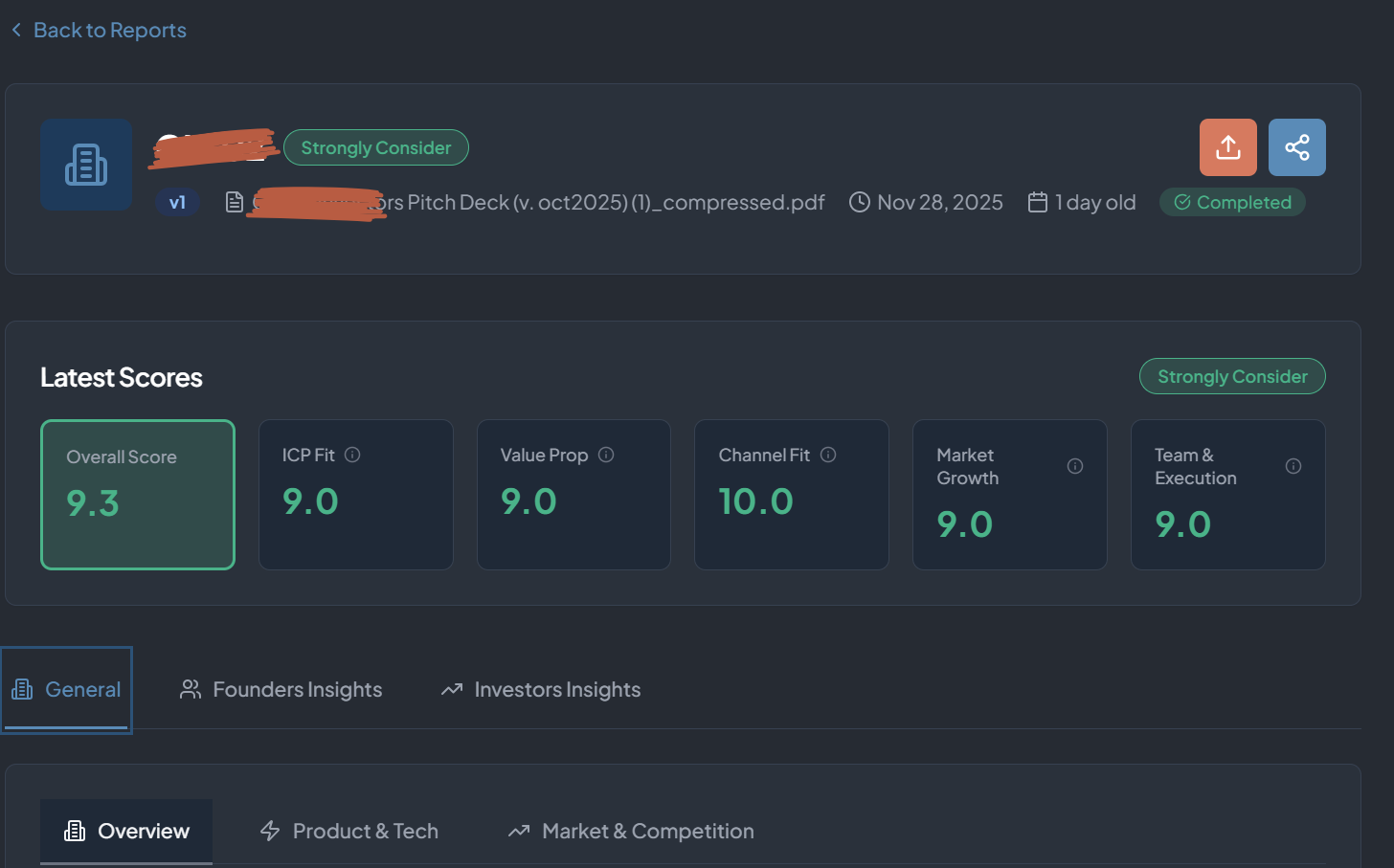

We are product-led and believe in bringing founders value from day 1. So we built our own product. Get value in less than 2 min by uploading your deck

Get Your Onwards Score (out of 10) (how investable you are)

See detailed Score breakdowns

Understand how a VC might decode your business

Get concrete deck recommendations

Upload new versions and see your progress!

How We Engage: Founder Stories

Which one are you?

Onwards works with a variety of founders with different painpoints.

Browse the different profiles and stories to understand how Onwards can be a true partner in you and your company's growth

The First-time Fundraiser

The Fundraising Founder is brilliant at building but struggles to translate that into a story investors believe. They have the early metrics and a strong team. But they've been pitching for months with limited traction. They don't have a rich uncle or an easy 'friends & family' route, much less a network of VCs. Their deck focuses on features instead of market opportunity. They need warm intros to institutional investors and don't know which metrics matter most. Without the right guidance, they risk running out of runway before closing their round. Bottom line - they need someone to give honest feedback and trusted introductions.

Profile snapshot

How Onwards Can Help

Craft a narrative that resonates

We've helped dozens of founders reframe their pitch from product features to market opportunity. We know what institutional investors need to believe to write a check, and we help you pressure-test your narrative with authentic, no BS feedback.

Get warm intros that count

Our network includes hundreds of VCs across thesis areas. We don't spray and pray—we strategically introduce you to investors who are the right fit for your stage and sector.

Build a fundable roadmap

Your roadmap should tell a story that connects today's traction to tomorrow's outcomes. We help you translate North Stars and OKRs into a roadmap that proves you can execute.

Prepare for board-level rigor

From practice pitches to board meeting collateral, we help you develop the communication, assets and strategic thinking that scales from Series A through Series B and beyond.

What Our Founders Say

From struggling to raise a Series A to a $XXM Series B in 18m

Before working with Onwards, we had a compelling vision but struggled to articulate it in a way that resonated with institutional investors. Onwards helped us reframe our deck, pressure-test our narrative, and build a roadmap that connected directly to revenue goals. We closed our Series A and went on to successfully raise our Series B.

A 3h session rewrote the story

Onwards didn't just help us get through demo day. That 3-hour session became the foundation for our entire go-to-market strategy and product roadmap. The narrative work we did together helped us secure our seed round and set us up for what came next.

We Have the Expertise to Help

Our deep (and evolving) Product Expertise

We believe that Product is the glue that keeps the company together. We use two frameworks to analyze company's progress, current status and where to prioritize support.

Framework 1: Scalable PMF

Product-Market Fit happens where Product, Market, and Distribution intersect. This is the foundation of scalable growth.

Framework 2: Customer Journey Fit + Data Growth Fit

Understanding how customers discover, adopt, and grow with your product, combined with data-driven growth strategies that scale.

Product-Market Fit

Does your product solve a real problem for a specific market?

Product-Market Fit

Summary

The foundation of all successful startups - when your product meets a real market need.

Deep Dive

Product-Market Fit occurs when you have a product that customers are actively seeking and willing to pay for. It's not just about having a good product, but having the right product for the right market at the right time. We've seen too many startups build features instead of solving problems. The difference? Customers who can't live without your solution versus those who can take it or leave it.

Key Focus Areas:

Product-Channel Fit

Can you reach your customers through the right channels?

Product-Channel Fit

Summary

Your product must be discoverable and accessible through channels your customers actually use.

Deep Dive

Product-Channel Fit means your product is optimized for the channels where your customers are most likely to find and engage with it. This includes everything from SEO to social media to direct sales. We've learned that the best product in the world means nothing if your customers can't find it. The channel isn't just how you reach customers - it's how they discover and evaluate your solution.

Key Focus Areas:

Channel-Model Fit

Do your channels support your business model?

Channel-Model Fit

Summary

Your distribution channels must be compatible with how you make money and scale your business.

Deep Dive

Channel-Model Fit ensures that your chosen distribution channels can support your revenue model and scale with your business. This includes considerations of unit economics, customer lifetime value, and operational complexity. We've seen startups with great products and channels fail because their business model doesn't work with their distribution strategy. The math has to work at scale.

Key Focus Areas:

Model-Market Fit

Does your business model work in your target market?

Model-Market Fit

Summary

Your revenue model must be viable and sustainable within your specific market context.

Deep Dive

Model-Market Fit means your business model is not only viable but optimized for your specific market conditions, customer behavior, and competitive landscape. This includes pricing, payment methods, and value delivery. We've learned that what works in one market might fail in another. Your business model needs to match how your customers actually buy and pay for solutions like yours.

Key Focus Areas:

Click any card to flip and reveal detailed explanations and key insights for each fit

Our Product Expertise

We bring deep product expertise across the entire lifecycle, from early-stage discovery to scaling growth loops and optimizing for retention.

Product Discovery

Understanding user problems and validating solutions before building

Product-Market Fit

Achieving and measuring product-market fit with the right metrics

Growth Strategy

Building sustainable growth loops and optimizing for retention

Data & Analytics

Setting up the right metrics and data infrastructure for growth

Portfolio

Companies we're proud to support